What is the maximum i can borrow on a mortgage

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. Our maximum fee can be up to 1 of your mortgage loan however we typically charge around 03 and our advisers will go through our fees and charges before any work is undertaken.

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

This page allows you to look up the FHA or GSE mortgage limits for one or more areas and list them by state county or Metropolitan Statistical Area.

. You can find out more about which mortgage is right for you with our mortgage guide or give us a call to talk to one of our mortgage experts. If you calculate your affordability based on estimated payments will ask for information about your desired mortgage like the maximum monthly payment term. Graduate students can borrow up to 20500 annually and 138500 total which includes.

Buying a home is one of the most important decisions you can make which is why well guide you through the process. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. Alternately you can ditch the math.

If you have student debt and are planning to buy a house the amount you can borrow on a mortgage will be lower because you have to be able to continue your monthly student debt payments as well. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. In general the maximum you can borrow is up to 80 of the available equity or the current value of your home minus what you owe on the mortgage otherwise known as loan-to-value ratio LTV.

The results page will also include a Median Sale Price value for each jurisdiction. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan. We work closely with you to explain underwriting guidelines credit requirements and the money you need to close on a mortgage loan.

Capital and interest or interest only. You can learn about some of our home financing options below. Borrow up to 500000 oac.

How much can I borrow. Working out how much you could borrow is an important part of choosing your new home and home loan. Our affordability and maximum home loan calculators can help you work this out.

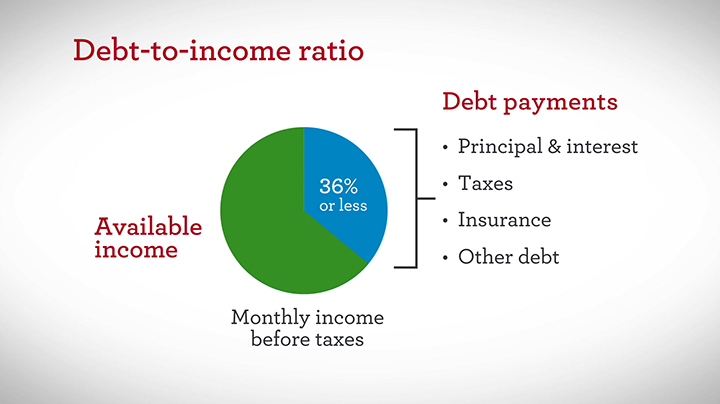

To access the maximum loan amount a borrower must have a good credit history and a higher credit score. Find out what you can borrow. Note both loans aim for a 36 DTI which is typical for a conventional mortgage.

However many popular loans with a max DTI of 43. The HUD reverse mortgage loan to value ratio depends on the borrowers age the current interest rate and the value of the home. The house must also be bought from a builder recognized by the program.

Most home buyers borrow at or below the 35 times. Learn More Home Equity Loan secured This is your maximum lending option. Can I Borrow more than 35 times gross income.

Navigating the home-buying process can be overwhelming. For 2019 the maximum reverse mortgage loan amount is 726525. Use our mortgage calculator to calculate your maximum mortgage with ABN AMRO in 2022 and get instant information on how much you can borrow.

Enter your details in the calculator to estimate the maximum mortgage you can borrow. The longer term will provide a more affordable monthly. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

There is no maximum debt ratio. Adjustable-Rate Mortgages ARMs 2. Based on these criteria undergraduates can borrow a maximum of 9500 to 12500 annually and 57500 total.

Annual Income yr. A Truliant mortgage loan officer will be happy to help you determine the right loan type for you and your situation before you apply. For all other purchase types re-mortgages rate switches and further advances we may charge a fee for advice recommendation research and application of the loan.

You can then see the results of the different mortgages you can apply for. Prudent Mortgage Corp. Use the following calculator to determine the maximum monthly payment PI and the maximum loan amount for which you may qualify.

Welcome to the FHA Mortgage Limits page. There are two different ways you can repay your mortgage. Subject to individual program loan limits.

The maximum loan amount is the highest limit amount that a lender can allow an applicant to borrow. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Monthly Debts mo.

However the lender must provide compensating factors if the total debt ratio is more than 41 percent. Those are the median price estimates used for loan limit determination. The equity loan scheme finances the purchase of newly built houses.

How long will I live in this home. This drastically affects how much they can borrow for a mortgage. You need to know how much you comfortably afford to repay given your other expenses and without impacting your lifestyle too much.

Larger loans also known as jumbo. There is no maximum loan amount. Avoid private mortgage insurance.

Subtract the amount remaining on your mortgage 200000 and youll get the approximate sum you can borrow as a home equity loan in this case 97500. After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI.

An adjustable-rate mortgage is a great option for you if want a lower rate during the fixed portion of your mortgage. VAs residual income guidelines ensure Veteran borrowers can afford the loan and determine how much money a Veteran must have left over after all debts and. First youll need to tell us the property value deposit and repayment term.

The mortgage should be fully paid off by the end of the full mortgage term. With a capital and interest option you pay off the loan as well as the interest on it. You can then find out how much you could borrow.

You should review your personal situation and work with your financial advisor to decide how much you can comfortably afford to borrow. Motorcycle Storage Loans up to 5000 in Toronto and GTA. You can borrow to pay down debts or any number of reasons.

With an interest only mortgage you are not actually paying off any of the loan. Or 4 times your joint income if youre applying for a mortgage. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies who will then contact you.

During the underwriting process lenders approve the maximum loan amount by evaluating borrowers credit history and debt-to-income ratio.

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Mortgage Calculator How Much Can I Borrow Nerdwallet

How Much Can I Borrow Home Loan Calculator

How To Get A Mortgage Without Financially Freaking Out Mortgage Tips Freak Out Mortgage

Mortgage Calculator How Much Can I Borrow Nerdwallet

Begonia Celorio Shojei On Instagram Ever Wonder How Much Home You Can Afford Thinking Of Increasing Your Payments With Our New Ap Begonia Instagram Canning

How Much Can You Borrow For A Mortgage Best Sale 50 Off Www Ingeniovirtual Com

Mortgage Calculator How Much Can I Borrow Nerdwallet

How Much Can You Borrow For A Mortgage Best Sale 50 Off Www Ingeniovirtual Com

What You Need To Know About 401 K Loans Before You Take One

How Much Can I Borrow For A Mortgage Fortunly Com

Pin On Ontario Mortgage Financing

How Much Can You Borrow For A Mortgage Best Sale 50 Off Www Ingeniovirtual Com

Bwsoeu 8pgnfjm

Mortgage How Much Can You Borrow Wells Fargo

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage